Nobel Prize winner at Accounting Summer School

The American economist Robert F. Engle won the Nobel Prize in 2003 for methods of analyzing economic time series with time-varying volatility. At the Accounting Summer School, organized by Prof. Lucie Courteau and Prof. Massimiliano Bonacchi, he gave an impromptu short lecture.

Prof. Engle, you started by studying physics and then did your PhD in Economics – how useful is it for students to combine different studies for their careers?

Robert F. Engle: I think more and more students are actually doing a lot of mathematics and science before they do economics. I think it is easier this way. I had expected that some of my physics ideas would be more useful in terms of models or mathematical concepts, but they were not. What they were useful for concerned how you can think about science. Whenever I’m faced with a dilemma, I ask myself what are the data telling us, what is the science in this? Are we forcing the issue or are the data really telling us this? This is the way a scientist thinks about the world, and I think it’s a good way to think about economics, too.

You said in your introduction to the Accounting Summer School that all research should be about rigor and relevance. How would you explain the methods that won you the Nobel Prize?

What I developed was a statistical approach to measuring risk, which is particularly useful in financial markets. And that’s how it is used.

You are now teaching at New York University, Stern School of Business and you started the V-Lab. Would you say that you dedicate your life to the volatility concept?

(laughs) It is probably the center of my research. But when you think about the financial crisis, you say ok, this is not just volatility, this is risk that is in the financial sector. And how is the financial sector risk related to the economy as a whole? So there is a whole area called macrofinance which tries to make the connection. Another kind of risk that I’m now focused on is climate change risk. How can we protect ourselves and how can we measure those long-run risks? Just because risks are in the distant future doesn’t mean they are less important.

So you view how the climate is changing in a different way to other people in your country?

There are different ways people choose to describe their refusal to do anything about it. They dispute not so much the fact that the climate is changing but that you can do anything about it. Mabe they will do something about it when the water rises too high and they’ll have to move NYC someplace else.

When you come to regions like South Tyrol, do you see or value prosperity, do you have this economic eye while travelling?

I do actually. I often ask people “how are things here”? I am very worried about Italy, but I don’t get the impression it’s so bad here in Bolzano. I don’t have any statistics about this region, but I see a lot of construction.

How did you and your wife first get to know South Tyrol?

We have come to Bolzano many times. We came for the first time in the early 70s to go walking in the Catinaccio, we went to some rifugi, and we loved it so much that we came back to do the Tre Cime.- We’ve also comeback to do the Sella group and to lots of other places. May wife said that before she had children she wanted to do the via Ferrata of Brenta, which we did. We went home, had our babies and then we brought our children here for holidays when they were small and now they come back on their own.

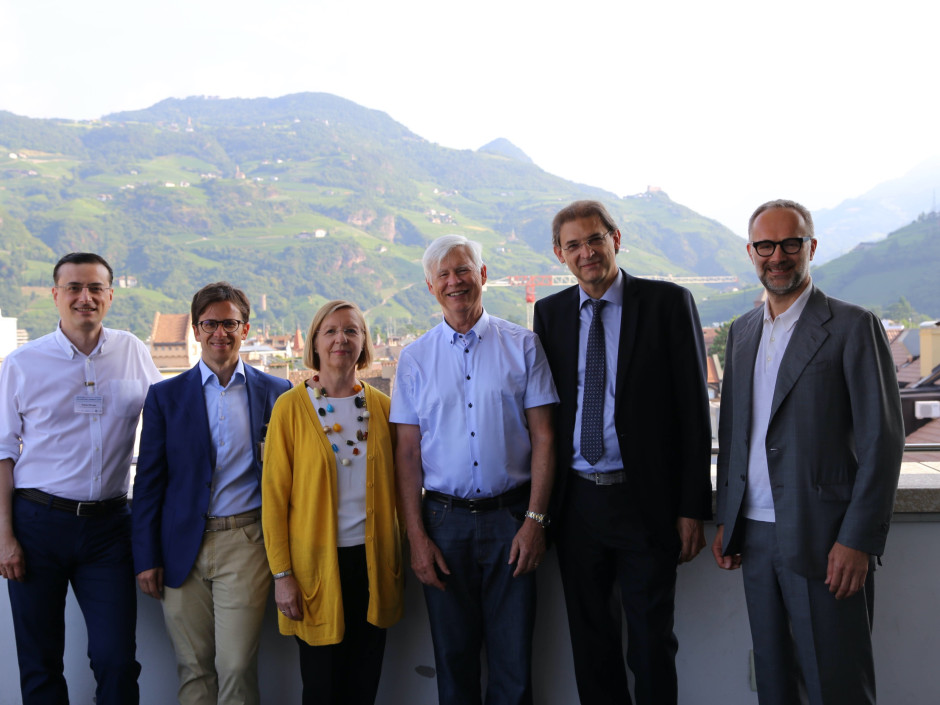

In the main picture from left: the professors Paolo Perego, Amedeo Pugliese (Università di Padova), Lucie Courteau, Nobel Prize winner Robert F. Engle, Rector Paolo Lugli and Massimiliano Bonacchi.

Related Articles

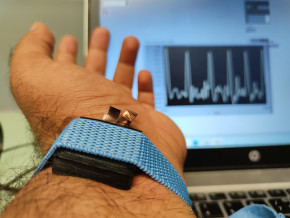

Tecno-prodotti. Creati nuovi sensori triboelettrici nel laboratorio di sensoristica al NOI Techpark

I wearable sono dispositivi ormai imprescindibili nel settore sanitario e sportivo: un mercato in crescita a livello globale che ha bisogno di fonti di energia alternative e sensori affidabili, economici e sostenibili. Il laboratorio Sensing Technologies Lab della Libera Università di Bolzano (unibz) al Parco Tecnologico NOI Techpark ha realizzato un prototipo di dispositivo indossabile autoalimentato che soddisfa tutti questi requisiti. Un progetto nato grazie alla collaborazione con il Center for Sensing Solutions di Eurac Research e l’Advanced Technology Institute dell’Università del Surrey.

unibz forscht an technologischen Lösungen zur Erhaltung des Permafrostes in den Dolomiten

Wie kann brüchig gewordener Boden in den Dolomiten gekühlt und damit gesichert werden? Am Samstag, den 9. September fand in Cortina d'Ampezzo an der Bergstation der Sesselbahn Pian Ra Valles Bus Tofana die Präsentation des Projekts „Rescue Permafrost " statt. Ein Projekt, das in Zusammenarbeit mit Fachleuten für nachhaltiges Design, darunter einem Forschungsteam für Umweltphysik der unibz, entwickelt wurde. Das gemeinsame Ziel: das gefährliche Auftauen des Permafrosts zu verhindern, ein Phänomen, das aufgrund des globalen Klimawandels immer öfter auftritt. Die Freie Universität Bozen hat nun im Rahmen des Forschungsprojekts eine erste dynamische Analyse der Auswirkungen einer technologischen Lösung zur Kühlung der Bodentemperatur durchgeführt.

Gesunde Böden dank Partizipation der Bevölkerung: unibz koordiniert Citizen-Science-Projekt ECHO

Die Citizen-Science-Initiative „ECHO - Engaging Citizens in soil science: the road to Healthier Soils" zielt darauf ab, das Wissen und das Bewusstsein der EU-Bürger:innen für die Bodengesundheit über deren aktive Einbeziehung in das Projekt zu verbessern. Mit 16 Teilnehmern aus ganz Europa - 10 führenden Universitäten und Forschungszentren, 4 KMU und 2 Stiftungen - wird ECHO 16.500 Standorte in verschiedenen klimatischen und biogeografischen Regionen bewerten, um seine ehrgeizigen Ziele zu erreichen.

Erstversorgung: Drohnen machen den Unterschied

Die Ergebnisse einer Studie von Eurac Research und der Bergrettung Südtirol liegen vor.